Following its acquisition of Anywhere’s brands, Compass looms large over real estate. Hundreds of agents and brokerage leaders wrote to Inman Intel to share their hopes, fears and priorities for the year ahead.

Inman On Tour

Inman On Tour Nashville delivers insights, networking, and strategies for agents and leaders navigating today’s market.

Inman On Tour Nashville delivers insights, networking, and strategies for agents and leaders navigating today’s market.

When Compass announced it would acquire Anywhere’s brands and cement its status as the largest player in the real estate brokerage world, some experts and observers expected it would give CEO Robert Reffkin more muscle to push for policy changes.

But in the first year at least, longtime Compass agents and their new ex-Anywhere counterparts alike appear to be focused more on the details of the transition, balancing brand autonomy with support for agents, and timely rollouts of Compass tech, an Intel analysis shows.

In its survey in late January, Intel fielded 375 written responses to an open-ended question from agents and brokerage leaders within and outside the newly combined Compass organization. For this report, every one of these responses was reviewed individually and analyzed as part of the comprehensive Intel text analysis.

These unvarnished thoughts from anonymous agents, brokers and executives reveal the hopes, anxieties and practical needs that are foremost on the minds of real estate professionals in this moment of mass consolidation.

Intel details its findings in the full report.

The inside vs. outside divide

Some of Intel’s questions this month for agents at acquired Anywhere brands were presented in a multiple-choice format — and Intel found that these agents were split on the topic of private listings in the new corporate structure.

But before reaching these questions, Intel sought less guided — and hopefully more representative — thoughts from real estate professionals both inside and outside the merger.

So Intel asked this question:

“Now that the Compass-Anywhere merger is closed, what is the single most important priority that the newly combined entity should adopt in 2026?”

In response to this open-ended question, 375 agents and brokerage leaders offered their thoughts on the direction Compass should head next. Some responses were a handful of words. Others were the length of a short essay.

An Intel journalist read through all these responses individually, noting common threads and takeaways for this report. In addition, Intel turned to a large language model to do what it does best: find and quantify patterns in the text.

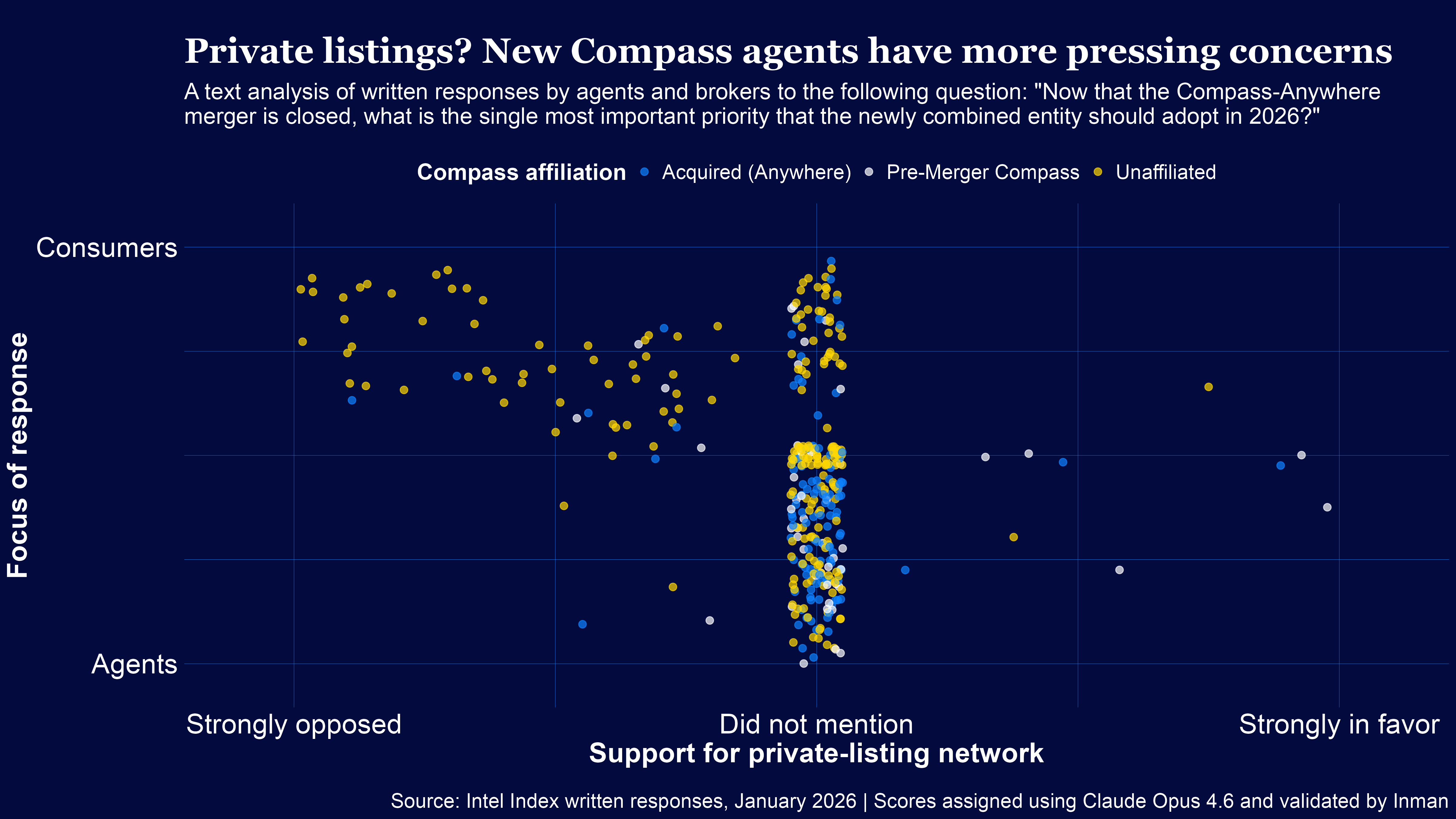

With detailed guidelines and definitions from Intel, the model scored each response on two spectrums:

- Support for or opposition to an expanded use of private listings over MLS and Clear Cooperation; and

- A focus on agent-centric language vs. consumer-centric arguments.

Intel then validated each score against the written response, determining that of the 375 written responses analyzed, only six were clearly mis-categorized, and another 19 may have over- or understated where Intel staff might have placed the same response on the spectrum.

This leaves more than 94 percent of responses that Intel determined were essentially representative — more than enough to paint a useful picture of overall sentiment.

And a clear takeaway that, whatever their opinions of the hot-button issues in real estate, agents and brokerage leaders under the Compass umbrella are mainly concerned with the day-to-day details of the transition — the ones that affect agents more than their clients.

“The top priority… should be retaining top agents by restoring clarity and trust post-merger. That means quickly simplifying systems, clearly communicating compensation and leadership structures, and proving that the merger delivers real, agent-first value. If agents feel secure and supported, the merger succeeds—if not, nothing else matters.” — Former Anywhere agent

Both longtime agents with Compass and those who only recently joined as part of the merger were significantly more likely to use agent-centric language in their responses, pointing to largely practical business concerns they hoped leadership would address in the coming year.

And while some former Anywhere agents did volunteer concerns about Compass’ direction on private listings, they were far less likely than outsiders to offer such negative critiques.

Agents and brokerage leaders outside the deal, by contrast, were far more likely to volunteer thoughts on Compass’ private-listing network — with a focus on ending its expansion.

Outsiders to the Compass merger were also more likely than any other group to couch their arguments in terms of what’s best for consumers, rather than what’s best for agents or the industry.

“Removing their 3-tier private listing system and returning to the MLS systems because maximum exposure produces maximum results for our clients… The bottom line of our clients should be the priority, not the bottom line of Compass.” — Agent unaffiliated with Compass

That’s what we see in this chart, which shows a significant cluster of yellow dots in the upper-left corner.

Chart by Daniel Houston

But perhaps just as telling is how many responses fall in the middle of the chart, indicating they did not mention this hot-button issue as the top priority for Compass.

A host of camps

In addition to scoring responses along these two specific spectrums, Intel used a language model to sort the responses into categories. This sorting was once again guided by and later validated by a human journalist.

But few pre-merger Compass agents named an expansion of the private-listing platform as the most important priority for their company in the coming year.

Instead, longtime Compass agents were more likely than other groups to press their leadership to aggressively fight Zillow.

And an even larger share of agents who were with Compass prior to the merger expressed urgency over resolving questions of brand identity — which varied mostly between support for keeping brands separate and uniting all the brands into a more cohesive culture.

“Separation of brands is important to me. I’m proud to be a Compass agent. I’m not a Coldwell Banker agent for a reason. They’ve recruited me and I’ve chosen to remain with Compass. I love our brand and I love my colleagues… I hope we don’t morph into one big blob of an industry.” — Pre-merger Compass agent

(Compass leadership has pledged that Anywhere’s brands will retain their independence and unique identities.)

Meanwhile the largest group of agents with the acquired brands said they hoped Compass would prioritize the tech integration — and many said that they wanted access to Compass’ platforms sooner rather than later.

Agents at acquired brokerages also emphasized the importance of Compass keeping its pledges regarding brand autonomy through the transition, as well as providing adequate support for agents and prioritizing financial stability and profitability.

These responses paint a more nuanced picture than previous Intel surveys, separating opinions on less pressing issues with more urgent priorities on the minds of agents and leadership.

Intel will continue to track this transition as it unfolds, from the issues within the new organization to those that affect the entire industry.

Methodology notes: This month’s Inman Intel Index survey ran from Jan. 22-Feb. 4, 2026, and received 643 responses. The entire Inman reader community was invited to participate, and a rotating, randomized selection of community members was prompted to participate by email. Users responded to a series of questions related to their self-identified corner of the real estate industry — including real estate agents, brokerage leaders, lenders and proptech entrepreneurs. Results reflect the opinions of the engaged Inman community, which may not always match those of the broader real estate industry. This survey is conducted monthly.

Email Daniel Houston

Topics: Anywhere | Compass Show Comments Hide Comments Sign up for Inman’s Morning Headlines What you need to know to start your day with all the latest industry developments Sign me up By submitting your email address, you agree to receive marketing emails from Inman. Success! Thank you for subscribing to Morning Headlines. Read Next More agents pondered an exit from real estate in 2025. Intel asks why.

More agents pondered an exit from real estate in 2025. Intel asks why.

If not Zillow, then who? Agents spar over preferred portal-war victors

If not Zillow, then who? Agents spar over preferred portal-war victors

Interactive dashboard: Explore results of January's Intel survey

Interactive dashboard: Explore results of January's Intel survey

Acquired brands are warming to Compass tech — but divided on Private Exclusives: Intel survey

More in Inman Intel

Acquired brands are warming to Compass tech — but divided on Private Exclusives: Intel survey

More in Inman Intel

Acquired brands are warming to Compass tech — but divided on Private Exclusives: Intel survey

Acquired brands are warming to Compass tech — but divided on Private Exclusives: Intel survey

Interactive dashboard: Explore results of January's Intel survey

Interactive dashboard: Explore results of January's Intel survey

Buyer, seller demand drives agent optimism to highest level in years

Buyer, seller demand drives agent optimism to highest level in years

Non-Realtor access has altered the MLS landscape. How common is it?

Non-Realtor access has altered the MLS landscape. How common is it?

Read next

Read Next

More agents pondered an exit from real estate in 2025. Intel asks why.

More agents pondered an exit from real estate in 2025. Intel asks why.

I read NAR's 40-page annual report so you don't have to

I read NAR's 40-page annual report so you don't have to

Ryan Serhant: Real estate's future is SERHANT. vs. Compass — and I'm ready to win

Ryan Serhant: Real estate's future is SERHANT. vs. Compass — and I'm ready to win

Acquired brands are warming to Compass tech — but divided on Private Exclusives: Intel survey

Acquired brands are warming to Compass tech — but divided on Private Exclusives: Intel survey