Although 2025 was a stormy one for the UK property market, Kate Faulkner reports a strong finish and positive start for 2026.

5th Feb 20260 438 4 minutes read Kate Faulkner OBE Despite the fact that, for much of the year, it felt like a roller coaster, 2025 ended really well for the property market.

Despite the fact that, for much of the year, it felt like a roller coaster, 2025 ended really well for the property market.

We lurched from one challenge to another, including SDLT changes and interest rates taking longer than expected to fall due to stubbornly high inflation. A late-year budget finale, with rumoured and potentially damaging property tax changes as well as particular disruption in the Prime market during the final quarter also added to the turbulence.

But, the industry delivered – again. Despite all these issues, agents, conveyancing lawyers and all other home-moving services stepped up as they always do and together, the property market delivered just under 1.2 million moves.

I always remind people who don’t work in the property industry, it remains something of a miracle, given the constant hurdles placed in the way of both the industry and consumers trying to buy or sell a home that we move so many people – and we only do so due the tenacity and dedication of industry professionals.

From a transaction perspective, 2026 looks good so far. According to Chris Watkin and TwentyEA data, new listings so far in 2026 are 23% higher than the 10-year average

But for now it is, in most areas and for many properties, still a buyer’s market. This is being driven by excess stock carried over from last year and new sellers coming to market in early 2026.

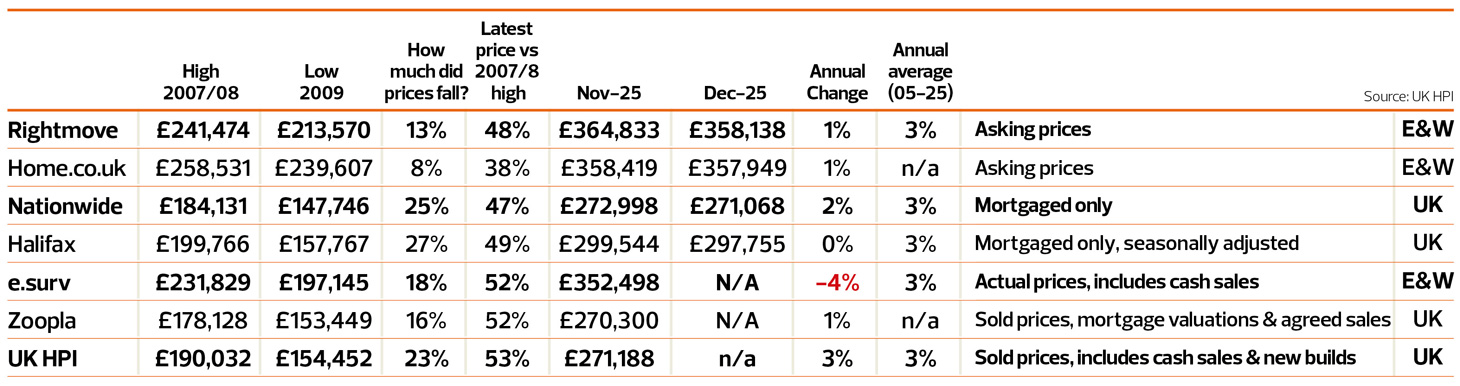

Insights from the property market indicesRightmove

– Average new seller asking prices fall by 1.8% (-£6,695) this month to £358,138. This larger than usual December drop means that prices are 0.6% (-£2,059) lower at the end of 2025 than in 2024.

– Bigger than usual Rightmove Boxing Day Bounce expected, as those who paused due to Budget uncertainty to join the post-Christmas boost in home-moving activity.

– Very early signs of post-Budget rebound, with number of top-end London sellers up by 24% week-on-week.

– The number of new sellers coming to market in the first half of 2025 was 9% ahead of the first half of 2024, which reversed to 4% below 2024 across the second half of this year.

– Buyer demand was 3% ahead of 2024 across the first half of the year, but 6% behind in the second half.

– It’s still been a more positive year overall for sales, with the number of sales agreed 3% higher than in 2024.

– Improved buyer affordability and plenty of choice for buyers suggests a market more like the encouraging first half of this year rather than the second half in 2026, with Rightmove predicting that new seller asking prices will rise by 2%.

Home

– The UK property market lies at a critical juncture. With overall growth trending to zero and possibly below, confidence is on the ebb even for the most seasoned property bulls.

– While the total unsold stock on the market has decreased over recent months, the current total is the highest January figure since 2015. Moreover, seasonal expectations indicate a rapid rise over the next six months

– Typical Time on Market (TTM) for unsold properties continues to move higher overall and is currently five days higher than in January last year.

Nationwide

– Despite the softer end to the year, the word that best describes the housing market in 2025 overall is ‘resilient’. Even though consumer sentiment was relatively subdued, with households reluctant to spend and mortgage rates around three times their post pandemic lows, mortgage approvals remained near pre-Covid levels.

– With price growth well below the rate of earnings growth and a steady decline in mortgage rates, affordability constraints eased somewhat, helping to underpin buyer demand. Indeed, the first-time buyer share of house purchase activity was above the long run average, supported by easier credit availability, with the share of high loan to value lending (i.e. with a deposit of 15% or less) reaching its highest level for over a decade.

– Flats have seen noticeably weaker growth than other property types in recent years. For example, over the last ten years, the price of a typical flat has increased by 18%, less than half of the rise in the price of terraced houses, which saw a 41% rise over the same period. This is partly a reflection of regional trends where London, which has a much greater proportion of flats, has underperformed the wider UK over the past decade.

Halifax

– Overall activity levels were resilient over the last year and broadly in line with the pre-pandemic average.

– While affordability pressures persist, the house price to income ratio was at its lowest in over a decade in December, striking a positive note for those looking to purchase their first home.

– On this basis, and recognising the headwinds that may affect buying power – such as the slowing of wage inflation and flattening employment rates – we expect a modest rise in house prices during the year of between 1% and 3%.

E.surv

– While property transactions enjoyed a seasonal uplift in October, more recent indicators suggest market sentiment was unsettled ahead of November’s Budget. While the prime parts of central London and other high-value residential areas were particularly vulnerable to this, the housing market in much of the country had also been in a state of relative torpor.

Zoopla

– Housing sales hit 1.2m in 2025 – the highest level for 3 years. – Mortgage rate stability, higher incomes and mortgage affordability improvements support sales. – Sales are higher but UK price inflation slows to 1.1% (1.9% in 2024). – First-time buyers are the largest buyer group in 2025 (39% sales). – Desire to move remains strong, subject to affordability. – House prices projected to increase 1.5% over 2026. – Estimated housing transactions total 1.18m in 2026. – North-south divide in price inflation set to remain.

5th Feb 20260 438 4 minutes read Kate Faulkner OBE Share Facebook X LinkedIn Share via Email